Table of Contents

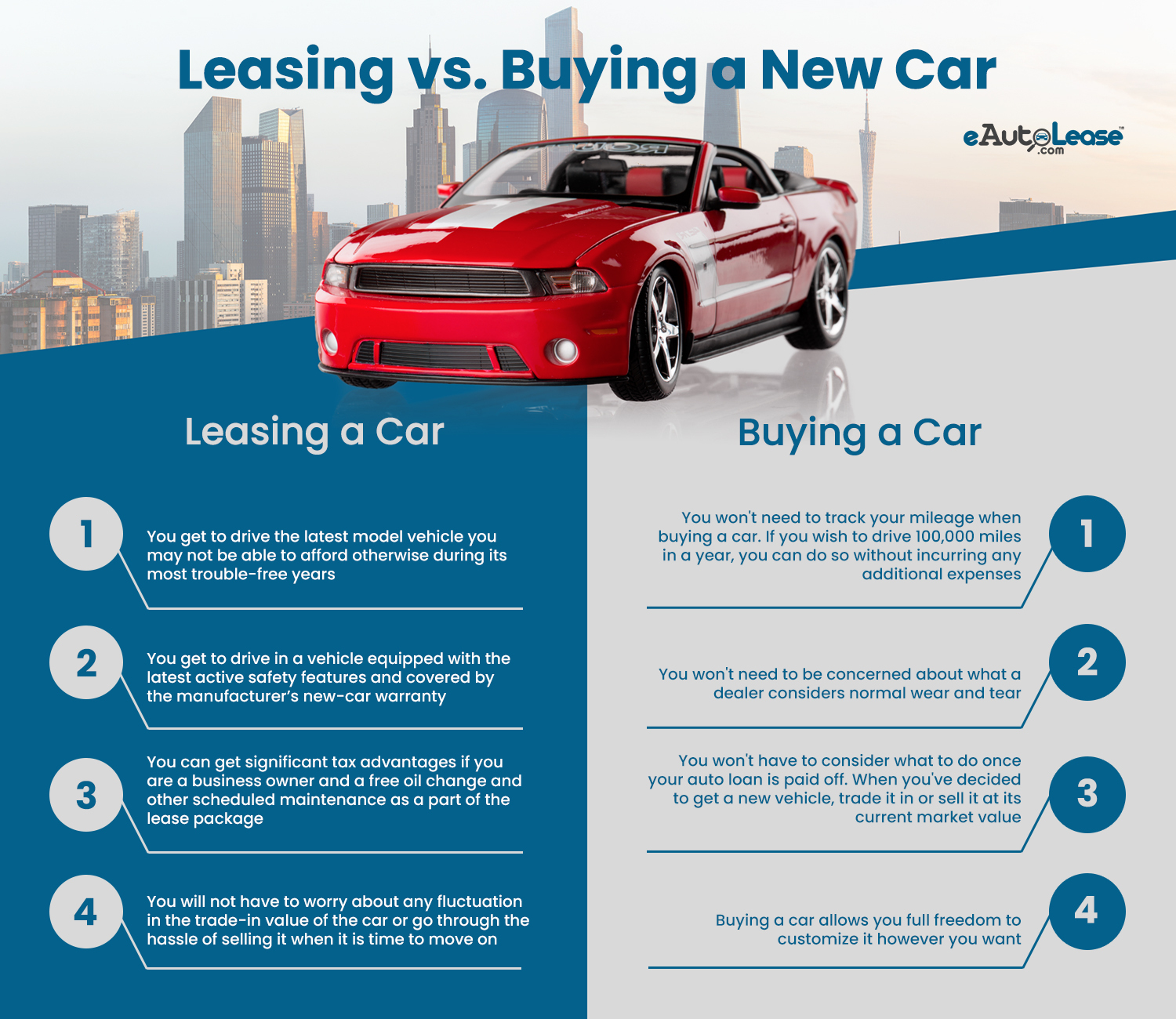

When it pertains to obtaining a Ford lorry, clients commonly deal with a crucial choice: should they lease or get? Both choices include their one-of-a-kind benefits and disadvantages, making it essential for prospective customers to recognize the advantages of each method. This overview describes the key advantages of leasing versus acquiring a Ford car, aiding you make a notified decision based upon your way of life and financial situation.

Access to the Newest Designs: Leasing usually includes much shorter terms-- typically 2 to three years-- enabling you to drive a new Ford version a lot more regularly. This means you can take pleasure in the most up to date technology, safety features, and design enhancements without committing to a lasting purchase.

Service Warranty Protection: Most rented cars are covered by the manufacturer's warranty throughout of the lease. This indicates you'll likely avoid major repair service costs, as the guarantee often covers most fixings and upkeep services. If a problem occurs, you can simply return the car without fretting about repair expenses.

Adaptability: Leasing supplies higher adaptability when it pertains to transforming cars. If you like to drive a new cars and truck every couple of years, leasing permits you to switch to a different model or type of lorry without the problem of selling or trading in a car.

Tax Obligation Advantages: In many cases, renting can offer tax obligation advantages, specifically for company owner. Depending on your state, you may have the ability to subtract the lease payments as an overhead, reducing your general tax liability.

Limitless Mileage: Leases usually come with gas mileage restrictions, and going beyond those restrictions can result in costly costs. When you get a lorry, you don't need to stress over mileage restrictions, making it excellent for those who drive regularly or take long journey.

![]()

Customization: Possessing a car permits you the flexibility to tailor it according to your choices. Whether you desire to include aftermarket accessories or make alterations, you can individualize your Ford without restrictions.

Prospective Resale Worth: While lorries generally drop with time, there is the capacity for resale value once you have actually settled the automobile. You can recoup some of your financial investment when it's time to offer or trade in. if you take excellent treatment of your vehicle.

No Month-to-month Payments After Loan Conclusion: When you have actually settled your finance, you can appreciate years of driving without the burden of monthly payments, making it monetarily advantageous in the lengthy run.

Ultimately, it's vital to analyze your top priorities and economic objectives when making this decision. Whether you pick to get or rent, the appropriate Ford vehicle awaits you, supplying integrity, performance, and the quality you get out of the Ford brand name.

Benefits of Leasing a Ford Automobile.

Lower Monthly Settlements: One of the most appealing aspects of leasing is the reduced month-to-month payments contrasted to funding an acquisition. Because you're basically spending for the depreciation of the car during the lease term instead than the complete price, renting often enables you to drive a new cars and truck for less money every month.Access to the Newest Designs: Leasing usually includes much shorter terms-- typically 2 to three years-- enabling you to drive a new Ford version a lot more regularly. This means you can take pleasure in the most up to date technology, safety features, and design enhancements without committing to a lasting purchase.

Service Warranty Protection: Most rented cars are covered by the manufacturer's warranty throughout of the lease. This indicates you'll likely avoid major repair service costs, as the guarantee often covers most fixings and upkeep services. If a problem occurs, you can simply return the car without fretting about repair expenses.

Adaptability: Leasing supplies higher adaptability when it pertains to transforming cars. If you like to drive a new cars and truck every couple of years, leasing permits you to switch to a different model or type of lorry without the problem of selling or trading in a car.

Tax Obligation Advantages: In many cases, renting can offer tax obligation advantages, specifically for company owner. Depending on your state, you may have the ability to subtract the lease payments as an overhead, reducing your general tax liability.

Advantages of Buying a Ford Vehicle.

Possession: When you get a Ford car, you own it outright as soon as the finance is repaid. This means you can keep the vehicle for as lengthy as you want, making it a more affordable option over time if you plan to maintain the car for several years.Limitless Mileage: Leases usually come with gas mileage restrictions, and going beyond those restrictions can result in costly costs. When you get a lorry, you don't need to stress over mileage restrictions, making it excellent for those who drive regularly or take long journey.

Customization: Possessing a car permits you the flexibility to tailor it according to your choices. Whether you desire to include aftermarket accessories or make alterations, you can individualize your Ford without restrictions.

Prospective Resale Worth: While lorries generally drop with time, there is the capacity for resale value once you have actually settled the automobile. You can recoup some of your financial investment when it's time to offer or trade in. if you take excellent treatment of your vehicle.

No Month-to-month Payments After Loan Conclusion: When you have actually settled your finance, you can appreciate years of driving without the burden of monthly payments, making it monetarily advantageous in the lengthy run.

Verdict.

Deciding in between leasing and getting a Ford lorry depends on your individual choices, monetary scenario, and driving habits. Leasing offers reduced regular monthly settlements, access to the most recent designs, and minimal maintenance expenses, making it an eye-catching option for several. On the other hand, acquiring gives the advantages of ownership, endless gas mileage, and modification choices, which might interest those who drive regularly or wish to maintain their vehicle long-term.Ultimately, it's vital to analyze your top priorities and economic objectives when making this decision. Whether you pick to get or rent, the appropriate Ford vehicle awaits you, supplying integrity, performance, and the quality you get out of the Ford brand name.

Navigation

Home

Latest Posts

The Benefits of Owning a CPO Land Rover

Published Dec 21, 24

2 min read

Certified Pre-Owned Land Rovers: What to Expect and Why It’s Worth It

Published Dec 18, 24

0 min read

Arrange Your Honda Solution effortlessly

Published Dec 12, 24

1 min read